A world of wonderful

Printables

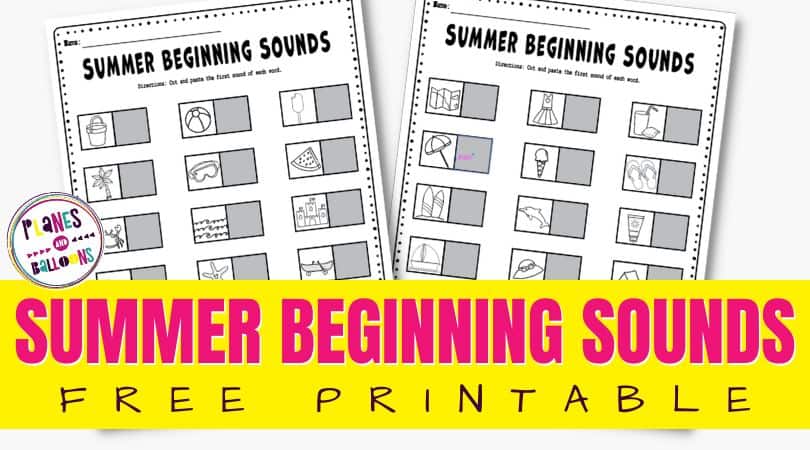

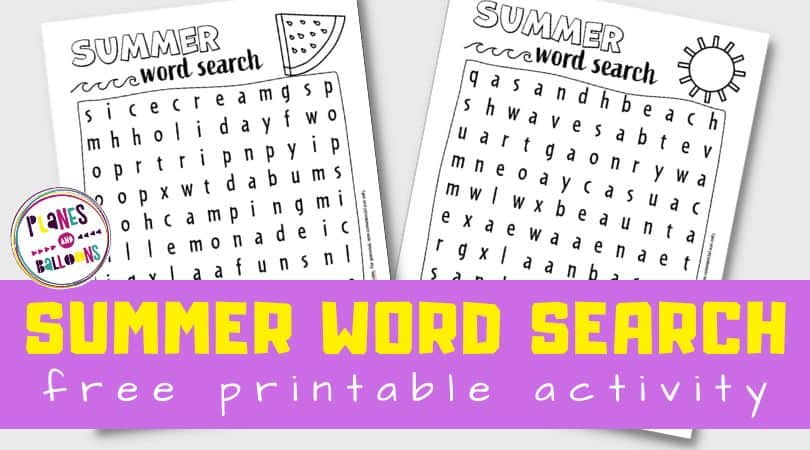

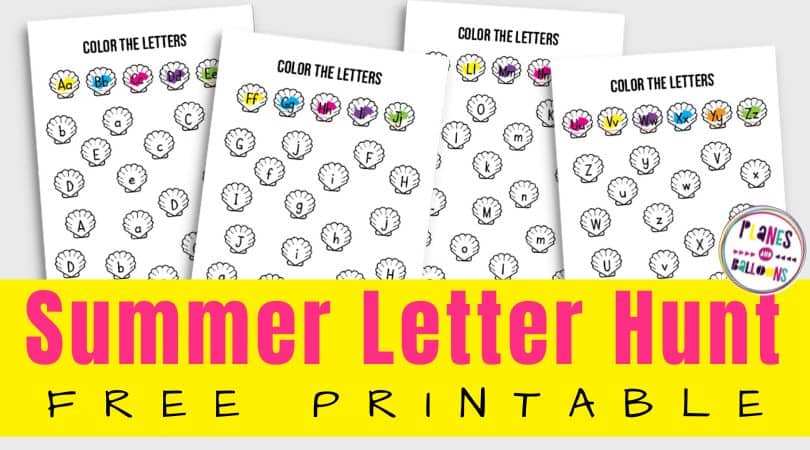

Explore high-quality resources for teaching your preschool,

kindergarten, and first-grade students!

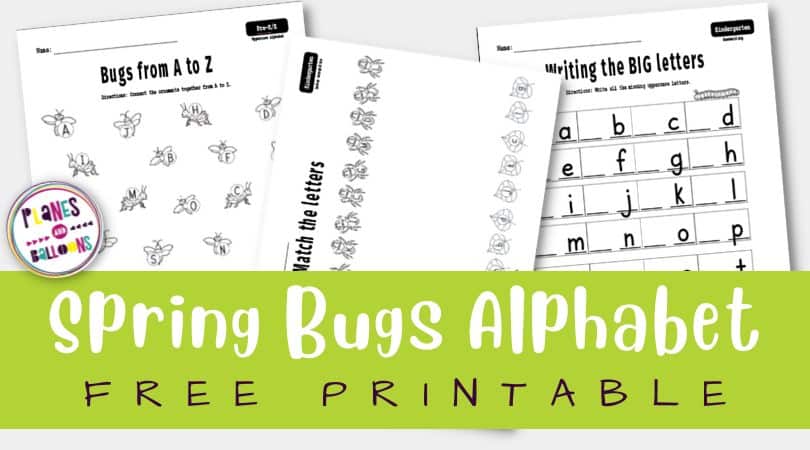

Free Printable Worksheets & Activities

Our mission is to bring you unique and low-prep teaching materials

so you can focus on what you do best – being an amazing parent and teacher!

The printables on Planes & Balloons are developed thoughtfully with the

youngest learners in mind.

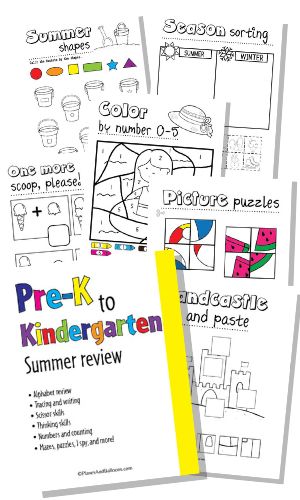

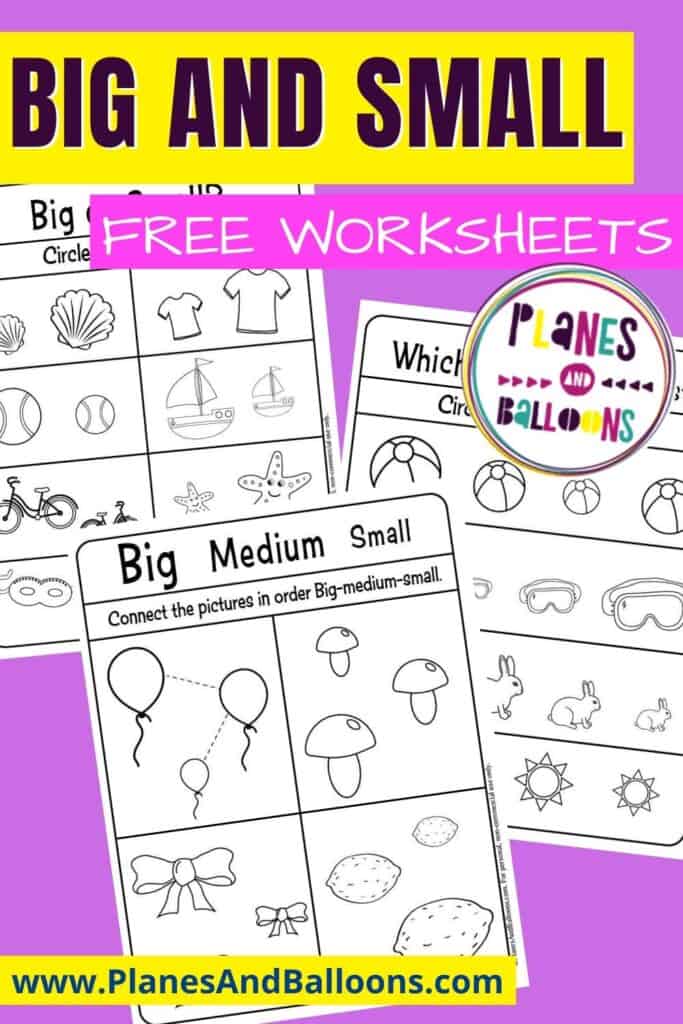

Preschool

Fun printable activities for your 3-4-year-olds. They will work on fine motor skills, learning the ABCs and 123s!

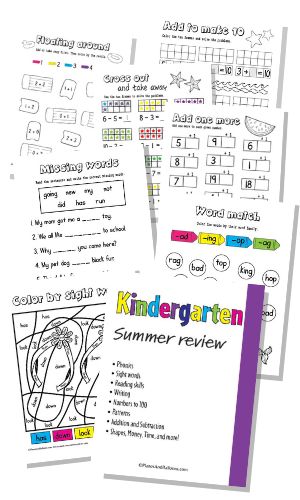

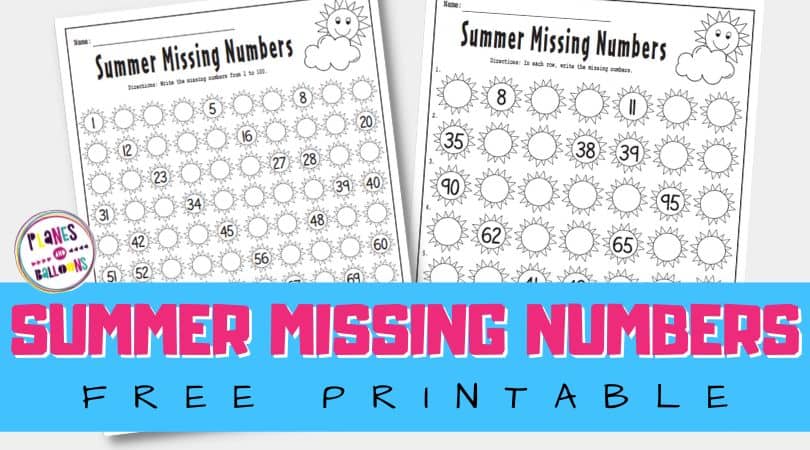

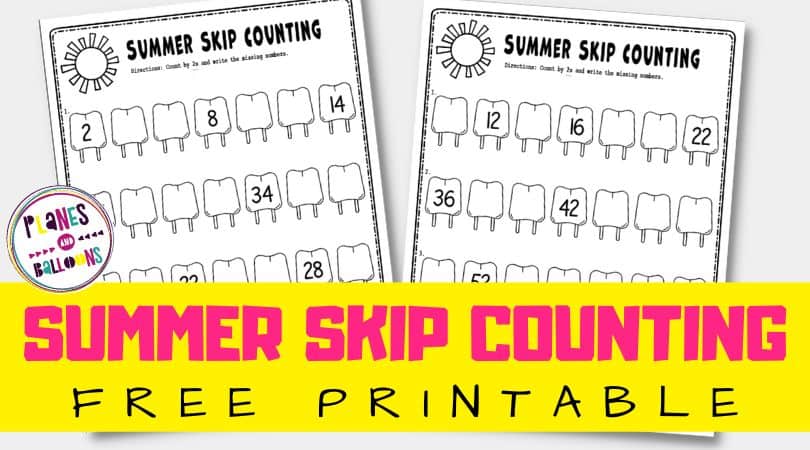

Kindergarten

Discover the many printables for teaching kindergarten math and English while keeping learning fun and enjoyable!

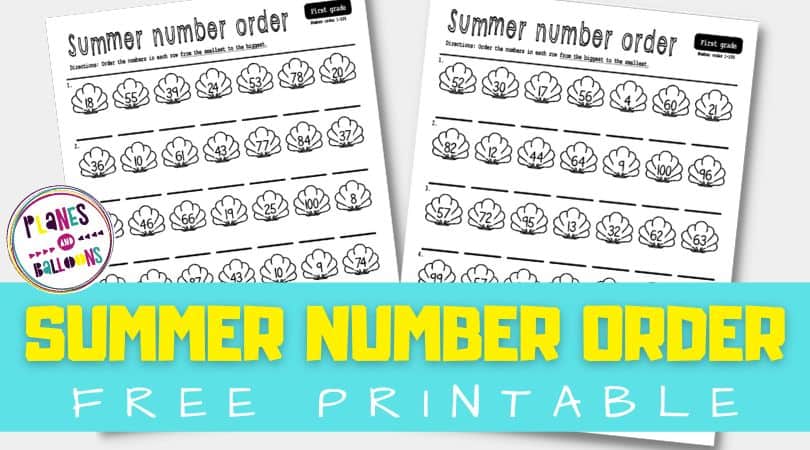

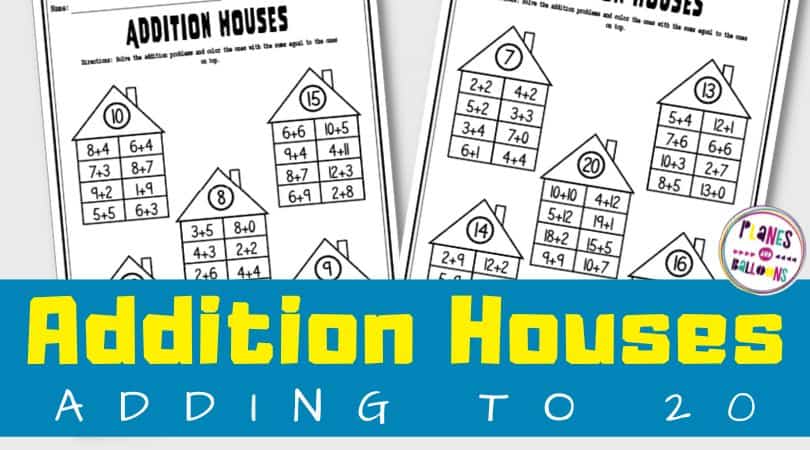

First grade

Our first-grade resources are a brand-new addition to the site. Check back often for new printables.

What others are saying

Join thousands of parents and teachers from around the world who love using our

printables in their classrooms and homes.

This website has been such an incredible resource for us! We’re starting our first year of homeschooling, and your pages have been such a big help for my 4 year old. Thank you so much for making these available.

~Kylee

As a former teacher, I can’t thank you enough for your website. You are such an amazing person to put these resources out here for everyone! We have so much fun doing all of these activities!

~Christine

THANK YOU!

Hi Kristina! Thank you for blessing people with your wonderful and amazing worksheets!!!

~Natalie

I’m using some for my preschooler and

kindergartner!!

They really love them.

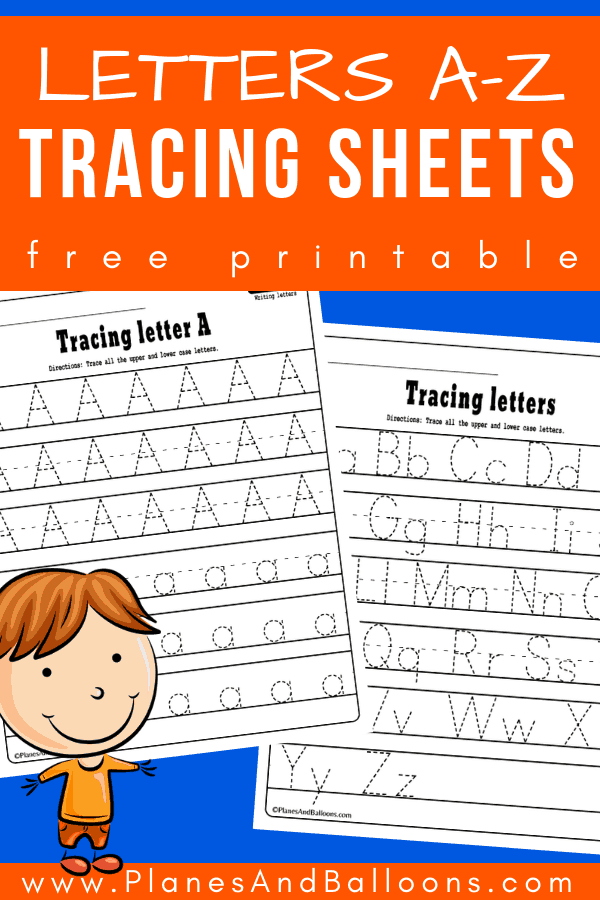

Shop Bestsellers

Explore our growing collection of premium printables, too!

You will find workbooks for teaching numbers, letters, phonics, scissors skills, and more.